The Autumn Statement 2024: How it affects your small business

You are using an outdated browser. Please upgrade your browser to improve your experience and security.

Here’s your breakdown of the major business announcements from the Autumn Statement 2024.

Rachel Reeves, the Chancellor of the Exchequer, delivered the Autumn Statement on 30 October 2024, saying that this was a budget intended to fix the foundations of the economy, deliver change for working people, mend the NHS and begin the process of rebuilding Britain.

On the whole, the announcements have been kind to the average worker, but will have a greater impact on UK small businesses. Increases in the minimum wage and employers’ National Insurance (NI) contributions, and changes to Capital Gains Tax are likely to be the big takeaways for most small businesses owners.

It’s a budget of short-term pain for long-term gain, with tough decisions made now to get the UK economy back on its feet and UK businesses on a more stable footing.

Tax increases overall by about £36 billion per annum. In addition to the £22 billion hole identified in the current year departmental spending, much of which recurs in future years, the previous forecasts for future years implied unrealistic cuts in all unprotected areas.

£24 billion of this comes from an increase in employers’ National Insurance, £6 billion from changes in capital gains and inheritance tax, and £4 billion from increased fraud detection and other HMRC compliance measures.

The balance of £2 billion comes from smaller measures, including the previously announced change to VAT on private school fees.

Employers’ NI contributions to increase

Employers’ National Insurance (NI) is currently charged at 13.8% on income over £9,100 per employee. This will increase in April 2025 to 15% on income over £5,000 per employee.

The additional costs will be reduced/eliminated for smaller employers by increasing the Employment Allowance from £5,000 to £10,500.

Capital Gains Tax (CGT) rates change

CGT is generally charged at 10% for gains falling within the basic rate tax band, and 20% for gains above that tax bracket.

From 30/10/2024, those rates will increase to 18% and 24%, aligning them with the current rates charged on residential property disposals.

BADR rate to increase

Business Asset Disposal Relief (BADR) levies a charge of 10% on the first £1 million of capital gains arising on disposal of qualifying businesses.

That rate will increase to 14% from April 2025, and 18% from April 2026.

Amendments to Inheritance Tax (IHT)

The current threshold of £325,000 generally, or £500,000 where a residence is passed on to direct descendants, has been extended by two years to April 2030.

From April 2027, pension pots and death benefits paid by a pension fund will be brought within the scope of IHT. Currently, certain agricultural property and businesses can be passed on free of IHT; from April 2026 the first £1 million will be exempt, together with 50% of the excess over £1 million, with the balance falling within the estate for IHT purposes.

Shares listed on the Alternative Investment Market (AIM) and held for more than two years are currently exempt from IHT; from April 2026 only 50% will be exempt, so an effective IHT rate of 20% on those shareholdings.

Other tax and duty changes include:

Stamp duty

The additional stamp duty on the purchase of second (and other additional) residential properties will increase from 3% to 5% from 31/10/2024.

Stamp duty on properties acquired by companies will also increase by two percentage points.

Business rates

Business rates relief of 40% for businesses in the retail, hospitality and leisure sectors will be applied from April 2025, capped at a relief of £110,000.

Electric vehicles

The 100% first year allowance on new electric vehicles has been extended for a further year up to 31/03/2026 (corporation tax) 05/04/2026 (income tax).

Double-cab pick ups

If you purchase a double-cab pickup with a payload of one tonne or more before 1 April 2025, you can enjoy the favourable tax treatment available on these vehicles including:

Double-cab pick ups purchased after that date will lose the beneficial treatment as they will be classified as cars.

Where these vehicles are purchased before 1 April 2025, you will continue to benefit from the previous tax treatment until the earlier of the disposal of the vehicle or 1 April 2029.

Fuel duty

Although widely expected to increase, fuel duty has remained frozen for a further year up to 22/03/2026.

Notable non-tax measures:

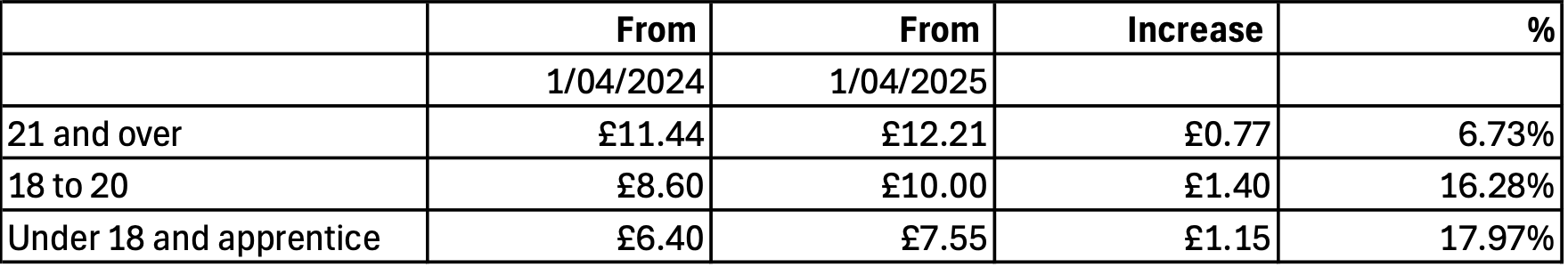

Minimum wage – minimum wages are increasing from April 2025:

Interest on late tax payments

Interest charged on late tax payments is going up by 1.5 percentage points to Bank Base Rate plus 4%.

Boost to HMRC compliance staffing

HMRC is increasing its numbers of compliance staff – effectively fraud detection – by 5,000 people by 2029/30 (ramping up, starting in November 2024) and by 1,800 staff in debt-management, focusing on collecting overdue tax and cracking down on non-compliance.

Non-dom tax regime to be replaced

The non-dom tax regime will be scrapped altogether, and replaced with a residence-based scheme covering new arrivals for the first four years of their UK tax residence. Details are yet to be announced.

As Rachel Reeves herself has said, this is not a budget that the Government would want to repeat. Some tough measures have been needed to fill the £22 billion hole in the public purse, and to set the UK Plc on a course that will drive the economy forward.

We have summarised the main changes in this newsletter.

If you’re concerned about any of the measures announced in the Autumn Statement, our team will be happy to run you through the major changes and their potential impacts.