National Minimum Wage Increases from 1st April 2024

You are using an outdated browser. Please upgrade your browser to improve your experience and security.

Although inflation is now on a downward trend, the sharp cost rises over the last 18 months are baked in. Energy prices are increasing again and the overall economic outlook isn’t very encouraging.

The good news is that by acting now to manage these increases you can stay on top of these costs. And with a proper financial plan, you can keep your business turning a profit.

A rise in the National Living Wage and Minimum Wage

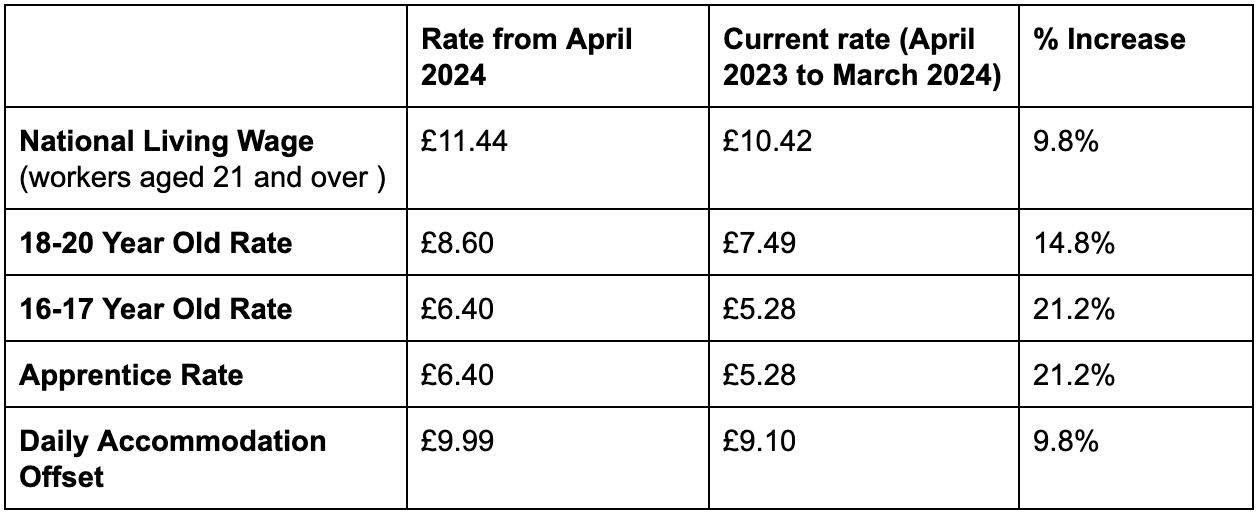

The rise in the National Living Wage and the National Minimum Wage (NMW) recommended by the Low Pay Commission was accepted by the Government in November 2023. This increase means that the NLW rises by 9.8% to £11.44 from 1 April 2024.

The size of your overall wage increase will depend on the age of your employees and whether they’re currently working as part of an apprenticeship scheme. However, the increase in your payroll costs is definitely something to factor into your financial planning for the year.

The new NLW and NMW rates from 1 April 2024 are:

Time to review your pricing?

Is it time to put your prices up? Ideally, your business should increase costs by a tiny amount each year, rather than by a big jump every five years, for instance. Small increases help prevent price shocks for customers, and keep your business in line with the rest of the market.

Can you also cut costs?

If you don’t think increasing your prices is an option, or you still need to make more of a change, you may need to cut back your spending. We look at your business line by line, so we can help you identify areas where you might be able to trim the fat.

Talk to us about managing your business costs

Keeping on top of rising business costs in 2024 will be a challenge. But with the right mindset, planning and forecasting, you can stay one step ahead of the curve.

Talk to us about helping you prepare a financial forecast for the next year or two to help you take control in the current economic headwinds.

Get in touch to talk about your financial future.